maine sales tax calculator

This means that depending on your location within Virginia the total tax you pay can be significantly higher than the 43 state sales tax. Alaska has no statewide sales tax but it allows cities and towns to levy sales taxes.

Which States Have The Highest Taxes On Marijuana Priceonomics

A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

. The sales and use tax of any given item or service is the combined rate of a state sales tax rate and any additional local sales taxes levied by a county or city. Find your state below to determine the total cost of your new car including the. This means that depending on your location within Nevada the total tax you pay can be significantly higher than the 46 state sales tax.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Calculating Sales Tax Summary. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Four states Delaware Montana New Hampshire and Oregon have no statewide sales tax or local sales taxes either. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. American Indians living on a reservation are exempt from car sales tax as long as the motor vehicle is.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Just enter the ZIP code of the location in which the purchase is made. The base state sales tax rate in Connecticut is 635.

This means that depending on your location within Missouri the total tax you pay can be significantly higher than the 4225 state sales tax. Connecticut sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. This means that depending on your location within Florida the total tax you pay can be significantly higher than the 6 state sales tax.

Average DMV fees in Virginia on a new-car purchase add up to 31 1 which includes the title registration and plate fees shown above. Combine county and city retail percentages. Oklahoma has a lower state sales tax than 885.

Keep in mind that sales tax jurisdiction rules can sometimes be too complicated to. You can use our Connecticut Sales Tax Calculator to look up sales tax rates in Connecticut by address zip code. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

This means that depending on your location within Idaho the total tax you pay can be significantly higher than the 6 state sales tax. Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. Iowa Documentation Fees.

Furthermore there may be limited sales taxes called special taxing district rates to help raise money for publicly-funded ventures like new schools parks or rail systems. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The 1025 sales tax rate in Chicago consists of 625 Illinois state sales tax 175 Cook County sales tax 125 Chicago tax and 1 Special tax.

Maine levies taxes on tangible personal property which includes physical and digital products as well as some services. The general sales tax rate is 550. Income Tax Calculator.

Missouri has a 4225 statewide sales tax rate but also has 747 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3718 on top of the state tax. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Maine State Income Tax Tax Year 2021.

The Tax Foundation an independent think tank weights local sales taxes by population and adds them to statewide sales taxes. Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635. Income Taxes By State.

Box 1060 Augusta ME 04332-1060. Florida has a 6 statewide sales tax rate but also has 368 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1036 on top of the state tax. Choose any state for more information including local and.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. You can use our free Maine income tax calculator to get a good estimate of what your tax liability will be come. Nevada has a 46 statewide sales tax rate but also has 33 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3366 on top of the state tax.

When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. Income Tax Sales Tax Property Tax Corporate Tax Excise Taxes. These fees are separate from.

These fees are separate from. This level of accuracy is important when determining sales tax rates. Idaho has a 6 statewide sales tax rate but also has 116 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of the state tax.

The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022. Many states allow local governments to charge a local sales tax in addition to the statewide sales tax so the actual sales tax rate may vary by locality within each state. The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 89 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county.

You can print a 1025 sales tax table here. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. The sales tax jurisdiction name is Chicago Metro Pier And Exposition Authority District which may refer to a local government division.

Virginia Documentation Fees. Find location on map. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Find your Connecticut combined state and local tax rate. Car Tax Rate Tools. New Mexico has 419 special sales tax jurisdictions with local sales taxes in addition to the.

Counties and cities can charge an additional local sales tax of up to 3563 for a maximum possible combined sales tax of 8693. Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426 on top of the state tax. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Virginia has a 43 statewide sales tax rate but also has 270 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1327 on top of the state tax. Groceries are exempt from the New Mexico sales tax. This means that income from capital gains can face a state rate of up to 715 in Maine.

The New Mexico state sales tax rate is 513 and the average NM sales tax after local surtaxes is 735. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Since there are no local sales taxes that is the highest rate you will pay.

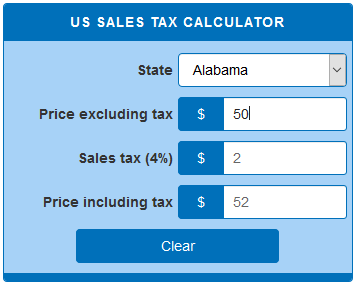

6 Titling Tax Manual. The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States.

State By State Guide To Taxes On Middle Class Families Kiplinger

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Your Guide To The United States Sales Tax Calculator Tax Relief Center

States Without Sales Tax Article

Cost Of Living In Bar Harbor Maine Taxes And Housing Costs

Sales Taxes In The United States Wikipedia

How To Charge Your Customers The Correct Sales Tax Rates

Item Price 71 49 Tax Rate 22 Sales Tax Calculator

State And Local Sales Tax Rates 2018 Tax Foundation

Property Taxes Urban Institute

Internet Sales Tax Definition Types And Examples Article

Property Tax Fairness Credit Sales Tax Fairness Credit

How Do City Taxes Stack Up It Depends The Ellsworth Americanthe Ellsworth American

Us Sales Tax Calculator Calculatorsworld Com

Welcome To The City Of Bangor Maine Excise Tax Calculator

Sales Tax Definition How It Works How To Calculate It Bankrate